The audiobook of Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron caught my eye over a year ago, but I didn’t read it because it’s 22.5 hours long. I’m not a finance expert, and I figured if it only took 10 hours longer to understand the entire life of Napoleon, then maybe it wasn’t worth wading into limited liability special purpose entities, broadband capacity trading, and Tobashi schemes.

But I finally listened to Bethany McLane and Peter Elkind’s exploration of the largest bankruptcy in American history (at the time). Then I read a whole lot of wikipedia articles, read a whole bunch of news articles from the early 2000s, talked to Byrne Hobart for an hour, and now I am going to attempt to present a succinct, yet comprehensive summary of what Enron was and how it fell.

As cliché as it sounds, what makes the Enron scandal so fascinating is its bewildering complexity. As late as 2001, nobody outside of Enron could actually explain what Enron did. Sure, outsiders could summarize it as a “logistics company” or say it did “energy trading,” but even the most diligent analyst didn’t know half of what Enron was up to because… well, Enron didn’t report half of what it was doing.

But at the same time, nobody inside Enron could really explain what the company was doing either. Sure, the executives knew more than the analysts, but such a vast company with so many opaque moving parts simply cannot be comprehended by a single mortal man. This isn’t embellishment – that was basically the legal defense of much of the Enron executive team after the company’s downfall. Many executives didn’t try to argue their innocence so much as confuse the judge, jury, and everyone in the courtroom with byzantine accounting non-explanations. Enron’s CEO, Ken “Kenny Boy” Lay, claimed that he honestly couldn’t follow the machinations of his hand-picked COO and CFO as they bounced billions of dollars of Enron assets and debt between corporate accounts and quasi-shell investment funds owned by Enron executives and their families so as to artificially boost Enron’s credit rating. Who could?

Beyond the technical aspects, the Enron scandal was arguably just as morally complex. This was probably my biggest surprise when reading the book. I had only heard about Enron in passing on the news as the ultimate example of financial dishonesty, or as the apex of predatory capitalism, and all of that might be true… or maybe not. It’s hard to say. I’m wary of passing judgement not just with the benefit of hindsight, but the benefit of being outside the reality distortion field which undoubtedly engulfed Enron for the better part of a decade. Enron’s executives were no angels, but they weren’t entirely demons or scoundrels or fools or decent men put under unimaginable pressure… they were all of those at once.

I’ll frontload the disappointment: there are no easy answers or smoking guns with Enron. There was no one executive who obviously made a conscious choice to commit fraud (at least not on a large scale). There was no single financial maneuver or strategy which was blatantly illegal. There was no identifiable point-of-no-return. There were just lots of morally weak but clever individuals who did what they thought they had to, or were allowed to, or what would work out in the end… until it didn’t.

I’ll start my piece with a summary of Enron’s entire history, starting with the origins of its founder, all the way to its dramatic conclusion. Then I’ll explain how and why Enron fell in three parts:

- Mid-Level Explanation – A condensed, digestible summary of the Enron scheme

- Low-Level Explanation – A deep dive into the mechanics of the various sub-components of the Enron scheme

- High-Level Explanation – An analysis of the legal and moral underpinnings of Enron’s scheme

The History of Enron in a Nutshell

(My goal in this section is to present a summary of Enron from an outsider’s perspective. I will go into the details of the company’s accounting practices, corporate culture, and crazy structure later, but for now, I want to frame how the meteoric rise and fall of Enron was seen by onlookers.)

At a time when American oil and gas men tended to resemble Daniel Plainview, Ken Lay (born in 1942) was a more refined entrant into the energy-industrial complex. Like most of Enron’s eventual executives, Lay came from Southern rural poverty, but clawed his way into academia through curiosity and sheer brainpower. He got a BA in economics from the University of Missouri, then a PhD at the University of Houston.

The University of Houston in the late 1960s may not have had the prestige and intellectual firepower of the coastal elite schools, but it was probably the best place in the world to learn energy economics. Through his studies, Lay and his professors determined that the US energy market was being hampered by a woefully outdated and over-extensive regulatory structure. Well before the days of fracking and America becoming a net oil exporter, drillers knew there were oceans of riches under US soil, the likes of which could propel the American economy to unseen heights and crash consumer prices forever. But both federal and state-based utility regulations were keeping prices artificially low. So while the energy market should have been a roaring boom market, instead it was a sleepy sector of the American economy stuffed with companies content to ride low-but-easy profit margins for eternity.

After a brief stint in corporate energy and the navy, Lay was hand-picked by a professor/mentor to work in the Pentagon. He stayed for less than a year before jumping to the Federal Power Commission and then the Department of the Interior. From the outside, Lay’s career was on a weird trajectory as he dove deeper into boring bureaucratic work. In reality, Lay was purposefully hanging around Washington DC to investigate whether the government really was moving toward deregulation as he and his college professors envisioned.

For Lay, deregulation wasn’t just a business opportunity, but a moral imperative. He was a true believer – a full-blooded free-marketeer Republican who knew the path to prosperity lay in unleashing private capital. He thought that it was only a matter of time before the American government woke up from its stupor, deregulated the energy markets, and unleashed the greatest energy boom in US history.

Hence, Lay’s grand vision – take over an energy company and steer it into the perfect position to capture the deregulatory windfall in the energy market when it inevitably occurred.

In 1974, Lay left Washington and jumped back into the private sector, starting with a natural gas pipeline company. He quickly garnered a reputation as a “nice guy,” but also a consummate politician. In a business full of Daniel Plainviews, Lay was a guy who could get people to work together, set up deals with rival companies, and establish a coherent long-term vision for his company. Over the next ten years, Lay climbed corporate ladders and bounced between regional firms until he landed as CEO of the Houston Natural Gas Company, a regional natural gas pipeline company which transported gas from producers to utilities to generate electricity.

In 1984, Lay’s company was acquired by InterNorth. Though InterNorth was larger, Lay used a combination of charisma, contract-maneuvering, and bribery to basically inverse the take-over. By 1985, Lay was running the merged companies with his executive team. To consolidate the Houston-InterNorth Corporation (lay had managed to slip into the contract that his firm’s name came first), Lay and his loyal executives rebranded the company as Enron.

Finally in command of ample resources, Lay shifted Enron to take advantage of the slowly deregulating energy market. Even during these earliest days of Enron, the company aggressively expanded, often leveraging beyond common-sense financial advice to expand its pipeline network and get more exposure to the natural gas market. Enron hummed along, making good-but-not-great profits as Lay continued anticipating a rapturous day of true deregulation.

In 1987, legendary consulting group, McKinsey & Company, sent Jeffry Skilling to help Enron develop a natural gas contract trading platform. This was arguably the very, very, very beginning of the end for Enron.

Skilling was a genius. That seemed to be the consensus of everyone who ever met him. In a company which would explicitly prioritize raw intelligence over all other factors in its hiring process, Skilling was still considered the smartest guy in the room. Like Lay, Skilling came from poverty, but worked his way into prosperity. Though unlike Lay, Skilling also repeatedly gambled his way out of prosperity, having made and lost minor fortunes through risky investments multiple times throughout his youth. In 1977, Skilling applied to Harvard Business School, and his interviewer asked him if he was smart. Skilling answered: “I’m fucking smart.” He got in.

Enron hired McKinsey to help it create a primitive futures market in natural gas. Prior to that point, the over-regulation kept natural gas prices so steady that there wasn’t much need for a trading market, so there almost wasn’t one. But as deregulation slowly unfolded, the price finally jumped up and down a bit, and Lay thought it might be a good idea to capitalize on this as a side project.

It was Skilling who realized the incredible potential of energy trading. Like Lay, he was an ideological free-marketeer and he fully believed in the deregulatory vision. But unlike Lay, Skilling thought buying and building pipelines was a bulky, slow, inefficient way to capitalize on deregulations. The true Holy Grail of energy profitability lay in trading. Thus, Skilling created the “Gas Bank.”

The Gas Bank was a sector of Enron that profited off price volatility by trading natural gas contracts by using its pipelines as a middleman between energy suppliers (miners) and consumers (usually utility companies). As natural gas prices went up or down, the suppliers and consumers were hit with unexpectedly high costs or low revenues. To flatten out those costs and revenues with hedges, companies could buy securities backed by natural gas from Enron. As long as Enron’s predictions about future natural gas prices were reasonably accurate, the company would profit.

For example: Say natural gas is currently priced at $100 per unit. Natural Gas Company X is worried that prices will fall by 10% over the next year due to unusually warm weather patterns weakening demand. But Enron’s analysts believe that prices will fall less than 5%. So Enron sells Company X a futures contract which promises that Enron will buy 1 million units of natural gas at $95 per unit. If prices fall to $90 as Company X predicted, then the company will sell its gas at the artificially high $95 price, and Enron will have to buy it at a loss. But if prices only fall to $98, then Enron still buys the gas at $95, and then can dump the gas back on the market at the $98 market price, thereby earning $3 per unit.

While there was an existing trading market at Enron and a few other pipeline companies, it was small, unregulated, and unstandardized. With Enron being the first company to truly stake-out this financial niche and channel top Wall Street talent into it, Enron rapidly built its own extraordinarily profitable financial market. Such trading is by no means an automatic money-printing machine, but as long as Enron’s traders were smarter and better informed than the competition (ie. Enron was the first energy company to have an in-house meteorologist), the company could dominate this rapidly growing market.

Over the following decade, Enron’s Gas Bank went from a weird little corner of the company to its reliable powerhouse earner. Skilling fell so-deeply in love with his creation that in 1990 he left a $1 million per year salary at McKinsey for 1/5th as much money to run the Gas Bank, which was expanded and rechristened as Enron Financial.

This is where CEO Ken Lay more-or-less leaves the story. He stayed as CEO throughout the rest of the company’s operations (besides a brief absence in 2001), but starting in the early 1990s, his hands left the wheel. Lay was content to set up Enron and let it run under seemingly competent managers. He was always a “big picture” guy and didn’t care much for the day-to-day operations, especially as his already large company expanded into new sectors about which he knew little. Instead, Lay became a famed socialite and political advisor who bounced between charity events in Houston, political committee meetings in Washington, and his burgeoning array of mansions. While Lay still attended board meetings and (arguably) was informed on big company moves, he pretty much abdicated real leadership of Enron in the mid-90s. Lay would die of a heart attack in 2006 after being convicted of ten counts of conspiracy and fraud + four counts of lying to auditors, but before facing sentencing.

Into the leadership void first stepped Richard Kinder, Lay’s Chief Operating Officer and second-in-command. Kinder became the go-to guy among the Enron executives to run by new ideas and ask for help, especially as Lay started barely showing up to work. Kinder was considered highly competent, but reactionary. His main function was to squash problems (or “alligators” as he called them), rather than come up with visionary plans. Despite respecting Kinder, Lay didn’t really like him since Kinder’s gruff mannerisms and abrasiveness clashed with Lay’s “nice guy” smoothness. In turn, Kinder thought Lay was a head-in-the-clouds absentee executive mooching off the company.

In hindsight, Kinder either kept Enron afloat by combatting the worst of its early insanity, or Kinder doomed Enron by solving cosmetic problems while allowing its cancerous core to grow. Either way, Kinder left Enron in 1996 as it became obvious that Lay would never surrender his CEO seat as previously promised. Currently, Kinder is the 67th richest person on earth with a $7.5 billion net-worth.

Kinder’s impending exit kicked off a desperate battle between Lay’s two all-star executives: Skilling and Rebecca Mark. While Skilling sat in Houston staring at computer screens, Mark travelled the world setting up Enron’s emerging global operations. She led the charge to build or finance power plants first in Europe, but then in array of increasingly unstable developing countries, like Brazil and China. As the only top female executive in the company, and an undoubtedly charismatic figure, Mark grabbed headlines and magazine covers as the daring face of a booming company.

This led to a fierce rivalry between not just Skilling and Mark, but competing visions for Enron’s future. Skilling wanted to entirely focus Enron on financial trading, and argued that physical assets were a low-margin waste of capital and time which weighed the company down. Mark believed that her global projects would not just give Enron a massive asset base on which to continue its growth, but catapult the company’s prestige to new heights as it powered developing nations to prosperity. In reality, both individuals were engaging in highly-speculative gambles which crippled Enron’s future for short-term gain, but neither knew it at the time. Mark’s Dabhol Power Plant in India is still one of the biggest corporate money sinks in modern history.

In the end, Skilling won the civil war by threatening to resign if Mark got the COO job. Thus, Lay appointed Skilling as Chief Operating Officer in 1997. He quickly marginalized Mark’s outsized role in the company until she left the core Enron team the following year to launch the ill-fated water subsidiary, Azurix. In 2000, Mark resigned from that post with an $82 million payout.

From 1997 onward, Skilling was the de facto head of Enron, and everyone knew it, including Lay. His vision was to build Enron into not just the central clearinghouse of the entire energy trading market, but to do the same thing in countless more not-yet-existing markets. The natural gas trading market had been more-or-less conceived, built, and captured by Skilling, so why not invent more markets and do it again?

As for all of those big, bulky pipelines and powerplants that Enron had been built upon – both domestically by Lay and abroad by Mark – they were considered no more than fuel for Skilling’s fire. They were rapidly mortgaged or collateralized to grow the existing trading operations and fuel new ventures.

Skilling didn’t just overhaul Enron’s structure, but its culture. The folksy, affable deal-makers of Lay’s day were swept aside by ambitious, hard-driving Wall Street-types. Skilling hired almost exclusively from Ivy League MBA programs and elite financial institutions. He purposefully bred an entrepreneurial atmosphere where brainiacs could come to Enron and launch their crazy ideas with the full support of their corporate overlord. Employees were constantly reshuffled between departments, subsidiaries were rapidly formed by close-knit teams to manage their own operations independently, and promising employees were rapidly promoted. At the time, many employees described Enron as the biggest start-up in the world.

Despite being considered a dark and brooding figure (with a well-known history of depression), Skilling was a surprisingly good salesman. His mark wasn’t energy customers, but Wall Street banks – the arbiter of Enron’s stock price. Armed with an astounding earnings growth target of 15% per year and some incredibly ambitious projects, Enron’s stock price went from $20 in 1997 to a peak of $92 in 2000.

From his own mind and those of his top lieutenants, Skilling launched a series of massive initiatives intending to recreate the magic of energy trading. There were too many ventures to describe here, and many never became more than fledgling side-projects (ie. wood pulp trading), but the two most notorious Enron projects were broadband trading and California electricity trading.

Skilling took over Enron during the early days of the dot-com bubble. The internet was all the rage, and the US was being tied together by new broadband networks. Skilling had always leaned on cutting-edge tech to bolster his trading operations, so he felt he had a firm grip on emerging tech trends. He predicted (correctly) that broadband demand would sky-rocket and that broadband providers would face ebbs and flows in demand which could be hedged in trading markets, just like natural gas companies.

But natural gas and oil had been drilled and used in some capacity for thousands of years. Broadband was less than a decade old. There was barely any broadband infrastructure, let alone a coherent framework for trading it. To generate and capture this potential market, Enron couldn’t just set up a trading desk in Houston for taking phone calls, rather, the company would have to construct thousands of miles of wiring to connect the dozens of scattered broadband networks together just so it could act as an intermediary.

So Enron dumped billions of dollars into its broadband operations. Early profits were meager to non-existent, but like all tech start-ups, Enron promised that extraordinary earnings were just around the corner. After all, it was the early days of the internet. Pets.com was worth $400 million. Skilling promised investors that Enron was perfectly situated to build and capture this inevitable market and reap extraordinary windfall – it was like Enron had built thousands of miles of pipeline before a massive oil rush. Skilling even went as far as to claim that the sheer potential of broadband trading already represented a third of Enron’s value by the early 2000s.

Broadband trading ended up being a fiasco for Enron. Even with heavy infrastructure funding, Enron could never capture the pipeline-ish middleman status it had in natural gas, and the burgeoning broadband market was still too small to capture the insane earnings Enron was promising its shareholders.

Enron’s other big venture was its most infamous: California electricity trading.

After much lobbying from Enron and other energy companies, California became one of the first states to partially deregulate its electricity market. Following the old Ken Lay strategy, Enron immediately jumped into the state and set up a massive trading operation with the intent of capturing profits as the hedging middleman between electricity producers and utility providers. Given the newly deregulated marketplace, there was sure to be high volatility in electricity prices, which created perfect market conditions for Enron to work its trading magic.

In a certain sense, Enron was enormously successful. Its California trading desk was so profitable that it literally hid its true earnings out of embarrassment. That’s because if you’ve heard of Enron for something besides its bankruptcy, you’ve probably heard of its connection to the rolling power blackouts which plagued California for two years. Such electricity shortfalls might be acceptable in Bangladesh or Nigeria, but not in the wealthiest state in the wealthiest country on earth.

Surprisingly, the blackouts were, at best, arguably, only a little Enron’s fault. Basically:

California’s new regulatory structure was a total crapshoot. Enron actually pushed for more deregulation, but California wouldn’t budge, especially on price caps for consumers. So Enron’s traders proceeded to ruthlessly exploit regulatory loopholes through strategies with cool-sounding names like “Death Star” and “Ricochet.” The net effect of these maneuvers was to artificially restrict the supply of California’s electricity, which compounded a trending increase in demand due to rising tech companies, and decrease in supply due to drought (which reduced hydropower production).

From April to December 2000, California’s wholesale energy prices increased 800%. But rather than raise prices on consumers, California utility companies had to keep their prices artificially low due to regulatory price caps. Thus, the utility companies had no choice but to strategically cut power in the form of rolling blackouts to conserve its supply. Governor Grey Davis temporarily approved direct government purchases of electricity to combat the crisis at the costs of tens of billions of tax-payer dollars.

Eventually the price caps were lifted and markets slowly stabilized, but in the wake of the crisis all fingers pointed at Enron. Its trading desk had made over $1 billion in 2000-2001, but its full earnings are still unknown.

Despite the bad PR rocking Enron’s stock down to the $80-range (from a high of $92), Skilling was riding impossibly high by 2001. He had ushered in an almost 5X growth of Enron’s stock over three years, bringing the company’s total value up to $70 billion in 2000. Every single year from 1996-2001, Enron had been named the “Most Innovative Company in America” by Fortune Magazine. Skilling himself was widely considered to be one of the best corporate leaders in America, alongside the likes of Steve Jobs. On February 21, 2001, Lay finally stepped aside as CEO and Skilling became the formal head of Enron. The company was set to continue its meteoric growth…

And then…

On March 15, 2001, Bethany Maclean (co-author of Smartest Guys in the Room) published an article in Forbes titled, “Is Enron Overpriced?” In it, Maclean claimed that, as far as she could tell, nobody outside of Enron actually knew how Enron made its money. She talked to seasoned Wall Street accounting experts who admitted to bouncing off Enron earnings reports with no understanding gained. Maclean simply asked how the hell all the analysts and investors could bid a black box so high.

Soon after the article’s release, Enron’s stock closed at $75.

Over the following months, Enron began hemorrhaging money. Analysts started asking more questions. Skilling called one short-seller an “asshole” over an earnings report call. The stock price tumbled.

On August 14, Skilling suddenly resigned as CEO less than a year after he had gotten the job, and Enron’s stock fell to $39.55. He cited “personal reasons” as the cause. No one besides Skilling and Lay (who returned to the CEO position) knew what that meant. Behind the scenes, Skilling was exhausted, deeply depressed, and wanted to spend more time with his children, especially after his divorce. He would eventually be convicted of 19 counts of fraud, conspiracy, making false statements to auditors, and insider trading, for which he would be imprisoned for twelve years. Skilling was released from prison in February 2019.

Enron’s cash-flow problem became dire. As the company’s credit rating fell below investment-grade, large debt-repayments were triggered. Enron needed to pay somewhere between $5-10 billion over the next few months to remain solvent; it has a few hundred million in cash on-hand. As the SEC started investigating Enron, Andrew Fastow, Enron’s Chief Financial Officer, “resigned.” Fastow would eventually be convicted of two counts of fraud, for which he was fined $23 million and sent to prison for five years. His wife would also be jailed for a year for tax fraud.

On October 26, the Wall Street Journal discovered the existence of “Chewco” (named after Chewbacca), a mysterious off-sheet special purpose entity owned by Enron. The entity held billions in Enron debt to which the shareholders were not privy. Enron’s stock price fell to $15.40.

In a desperate Hail Mary play, Enron tried to sell itself to Dynegy, it’s longstanding competitor, for $10 per share. At the start of the year, Enron had been five times bigger than Dynegy. The deal seemingly closed, but then collapsed within weeks as Dynegy finally got a close look at Enron’s books.

On December 2, 2001, Enron filed for the largest bankruptcy process in American history at the time. Its shares were worth $0.26.

Why Did Enron Fall?

This is such a big question that I need to break it down into three parts. For ease of explanation, I am going to start with what I call the “Mid-Level Explanation,” which is the most succinct and general summary. Then I will go into the “Low-Level Explanation” which gets into the nitty-gritty details of Enron’s various schemes and why they collapsed. Finally, I will go into the “High-Level Explanation” which looks at the company’s leadership, ideas, and values which ultimately caused its downfall.

/https://www.thestar.com/content/dam/thestar/business/2019/04/08/former-enron-ceo-jeffrey-skilling-settles-17-year-old-suit-over-company-collapse/enron_skilling.jpg)

The Mid-Level Explanation

In a nutshell:

Enron was an inadvertent Ponzi scheme that used obfuscatory accounting practices to conceal bad assets and mounting debt to maintain a viable credit rating to attract further investment. As the scheme grew, Enron’s cash-flow continued to dwindle as real earnings fell further behind reported earnings. Simultaneously, Enron had to resort to bigger and bolder accounting maneuvers to cover its fundamentals. These practices attracted the attention of market skeptics who triggered a quasi-bank run on Enron which greatly exacerbated its cashflow problem, thereby precipitating a rapid collapse in Enron’s entire financial structure in 2001.

Even with its debt hidden, how did Enron attract so much capital? How did a large but regional natural gas pipeline company balloon into a $70 billion global energy juggernaut?

Basically, Enron used a combination of marketing-driven hype and misleading accounting to trick investors into misunderstanding Enron’s basic money-making operations.

Much of this trickery was centered on Enron’s “price-to-earnings ratio” (P/E ratio), a commonly used metric for financially valuing a company. The P/E ratio is “stock price/earnings per share.” For instance, if Company X has 10,000 shares, each of which trade for $1, and the company earned $5,000 this year, then its P/E ratio = (1/(5,000/10,000)) = 2.

An average P/E ratio for a company in the S&P 500 was in the 10-20 range in the 1990s. A higher P/E ratio indicates that a company is expected to increase its earnings in the future, thereby allowing the stock price to “catch up” to the earnings. For instance, tech start-ups tend to have super-high P/E ratios as they have low initial earnings in anticipation of future breakthroughs. Even large and fully mature tech companies like Google have 30+ P/E ratios.

When Skilling was appointed COO of Enron in 1997, he had a bold plan for pushing the company forward with aggressive expansion of existing trading operations and the creation of entirely new trading markets. To accomplish this strategy, Enron needed tens of billions of dollars in capital, but the company was already highly leveraged, largely due to Mark’s overseas shopping spree.

To attract more capital, Skilling would have to keep growing earnings, and so he picked a completely-bonkers-in-retrospect earnings target of 15% annually. Consistently hitting that target by launching multi-billion dollar power plant construction projects simply wasn’t feasible, which gave Skilling all the more reason to position Enron away from its asset-based logistics roots and towards Skilling’s preferred asset-lite trading operations.

But here was the central problem: trading companies have low P/E ratios. Goldman Sachs may very well be the best trading company in the world, but in the late 1990s, its P/E ratio typically stayed below 10 (today it’s 11-12). Companies which make their money off big, heavy pipelines and powerplants may be capital-intensive, but they generate steady profits. In contrast, trading operations are inherently volatile. Sure, traders can be smart and have the best data available to them, but they’re still basically gambling on future prices. No one can be right all the time.

Skilling’s business model for Enron would cause it to have a low P/E ratio. A low P/E ratio meant a low stock price relative to the company’s profits. That meant a higher debt ratio, less equity value to offer, and generally weaker capital-raising abilities. But Skilling needed to raise lots of capital to fund Enron’s expansion.

So Skilling’s solution was to pretend that Enron wasn’t a trading company. Even though it was.

This is why throughout Skilling’s tenure as COO, he obsessively referred to Enron in earnings reports, interviews, and shareholder presentations as a “logistics company.” Even though Skilling’s Enron pretty much stopped buying assets, mortgaged the assets it already had, and generated the vast majority of its profits from trading, Skilling maintained the façade of Enron being an old regional pipeline company. In reality, by the late 90s, Enron was basically a massive hedge fund.

Thus Enron presented itself as a financial contradiction. It consistently established and met earnings targets that no “logistics company” ever could, by utilizing its far more profitable trading components. But then Enron pretended it wasn’t a trading company and received stock valuations using metrics normally reserved for “logistics companies.”

By 2001, Enron’s P/E ratio reached an astounding 67. At the time, with the finance industry in a dot-com-driven frenzy, Goldman Sach’s P/E ratio was 17. Over the previous four years, Skilling’s Enron had reaped the rewards of an absurdly inflated stock valuation and had built Enron into one of the premier energy and financial companies in the world.

How exactly did Skilling do all this?

Part of the explanation was some combination of a reality-distortion field created by Enron’s past success, and Skilling’s sheer charisma. It was simply established wisdom that Enron was a phenomenal company. They almost never missed their sky-high earnings targets. They rolled out crazy projects and brought them to fruition. Skilling was a super genius who read markets like the Matrix. Analysts and the media heaped endless praise on a company that could do no wrong. Only a few dour contrarians dared question Enron’s success, and even then, it was only after many years of bad practices.

But the rest of the explanation is more technical. It’s hard to actually judge the skill of Enron’s traders due to the events surrounding them, but they most likely really were good at what they did. They may have even been as great as Skilling and others thought. But they weren’t perfect. Bad bets were made, assets were mishandled, and in such an uninhibited corporate culture, costs spiraled out of control. The only way for Enron to consistently post such high earnings when their real earnings were highly volatile due to the inherent nature of financial trading, was to hide losses.

And the way Enron hid its losses was through creative accounting.

The Low-Level Explanation

I conceive all of Enron’s schemes as attempts to decouple the map and territory. Enron, as a business, existed at an objective level of financial health in reality (the territory). Enron’s accounting, as reported to its accounting firm, Wall Street, and the credit rating agencies, was an approximation of this reality (the map). Essentially, Enron engaged in practices of varying honesty and legality which consistently made the map look better than the territory.

Mark-to-Market Accounting

When Skilling formally joined Enron in 1990, a condition of his employment was for his department’s finances to be put under Mark-to-Market accounting (M2M) standards. Seven years later, when Skilling ascended to COO, he mandated M2M accounting for the entire company. While M2M is not an inherently fraudulent practice, and is even superior to standard accounting in particular contexts, Enron’s use of M2M was arguably its biggest source of fraud.

In standard accounting, a company reports profits and losses as they are realized. Let’s say in 2010, Company X spends $10 million building a powerplant which it expects to earn $5 million per year after operating costs for the next 20 years. So in 2010, Company X reports $10 million in costs and no revenue on the project. In 2011, it reports $5 million in profits. It will proceed to report the same profits over the coming 19 years. Of course, the factory could blow up or the price of electricity could rise, so profits could decrease or increase accordingly.

With M2M, companies report the entire estimated losses and profits on a deal into the future as soon as the deal is made. Let’s say in 2010 Company X makes the same powerplant deal. Under M2M, the company will report $90 million in earnings on the project (($5 million*20 years)-$10 million) in 2010. If the powerplant blows up or electricity prices rise, the company will then adjust the projections accordingly in the present year.

Whether M2M works (that is, whether it reflects the “territory” accurately) is entirely dependent upon the quality and honesty of the accounting projections. With good projections, M2M can show a more accurate representation of a company’s financial health than traditional accounting by incorporating future prospects and losses. But of course, bad projections can make a company’s accounting wildly divergent from the underlying company.

Which is exactly what happened at Enron.

The projections upon which Enron’s M2M profits were based were just that… projections. They were speculations. Guesses. Enron’s deals, whether in the trading market or in physical assets, were often based on energy prices. How reliably can anyone, even the greatest investor on earth, project the price of natural gas for the next twenty years? Or better yet, how reliably can anyone predict the odds of a Brazilian provincial government nationalizing an Enron powerplant over the same timespan?

As far as anyone can tell, no Enron executive ever ordered an employee to make an inaccurate projection. But that hardly mattered. Consider an Enron deal-maker who has to sit down with his team and design a profit model for their project. A higher projection meant a higher bonus for him and his team, it made Skilling and the executives happy, it boosted Enron’s stock price, and it fueled the collective sense of camaraderie at America’s most innovative company. A lower projection meant… the opposite of all that.

As with so many of Enron’s schemes, the dishonesty was rampant, but inadvertent. Exaggeration became the norm at Enron, then it became expected, and then it became required. Enron regularly booked earnings that were tens of millions of dollars higher than their long-term trading contracts or assets would ever earn in reality.

Theoretically, the accuracy and honesty of projections was supposed to be maintained by Arthur Andersen (AA), Enron’s third-party accounting firm. But Enron was one of AA’s biggest clients and AA didn’t want to piss them off through excessive scrutiny, especially since Enron purposefully hired other accounting companies to handle secondary accounts with the implicit threat that they could take AA’s prime position at any time. Plus, by all accounts, the accountants AA staffed in Enron’s corporate headquarters legitimately bought into the hype that Enron was this infallible company which did the impossible every quarter. So year-after-year, AA signed off on insane M2M projections and Enron booked massive profits that had yet to materialize and never would.

And then there were Enron’s projection readjustments.

Let’s say Enron builds a powerplant and projects earning $60 million over the next 20 years. Under M2M, Enron immediately books a $60 million profit. But then five years later, Enron is struggling to hit its quarterly earnings targets. Maybe it’s $50 million short. So…

An executive might go to one of his analysts and strongly indicate how great it would be if that powerplant project were to make some extra money over the next 15 years. It would be so awesome. Everyone would be so happy about it.

So the analyst might call up some Harvard professors, find some new-fangled electricity-pricing-projection-model, and re-crunch the numbers with some hyper-optimistic inputs.

The analyst finds that lo-and-behold, the old projection was wrong. The super fancy Harvard model (which everyone can trust because it’s from Harvard) says that electricity prices will rise more than previously expected, and therefore the powerplant will generate $100 million in profits over the next 15 years instead of the old model’s $45 million.

The analyst tells his boss and he’s thrilled. The boss officially readjusts the accounting projection, and banks $55 million in profits for this quarter. Enron hits its earnings target, its stock price goes up, the boss gets a bonus, the analyst gets a bonus, and Skilling gives a big speech to the whole company about how proud he is that everyone is working so hard.

That may all sound ridiculous, but it was common practice at Enron. Reevaluating projections was the fastest and easiest way to make profits materialize out of thin air, at least on paper. Virtually all of Enron’s assets and trades were over-valued by M2M, but some valuations went deep into crazy land, with banked profits sometimes reaching almost five times the eventually realized earnings. Most infamously, a chronically troubled offshore oil rig in South America made over $120 million on Enron’s books, when in reality it never delivered more $25 million in real dollars to Enron’s coffers.

For Skilling, M2M offered a miraculous method of accelerating business expansion. Basically, Skilling’s process was:

- Come up with some crazy project

- Pitch the project to analysts and investors

- Claim earnings in the present based on wildly over-optimistic projections fueled by analyst/investor support

- Watch Enron’s stock price rise

- Borrow more money as allowed by the higher market cap and lower debt ratio

- Spend the money on the crazy project

- Repeat the process

Skilling’s broadband trading expedition was probably the best example of this. It was indeed a bold, daring, visionary business plan, but it was either way too far ahead of its time (at best) or utterly divorced from reality (at worst). Yet Enron spent billions of dollars on buying up broadband equipment, setting it up across the country, paying ace traders to craft innovative contracts, etc. Skilling then used his entire broadband platform to boost Enron’s stock price by around 20%, though he argued to analysts that it should have been worth twice that. But back in the real world, the entire broadband operation only generated $10-30 million for Enron throughout its existence.

But that’s the thing… for a long time, it didn’t matter how much money these ventures really earned because Enron basically operated like a Ponzi scheme.

If Enron’s projects brought it cash, that was great, but if they didn’t that was ok too. Even if a project failed in the long-run, Enron could still bank immediate profits and use its inflated financials to borrow more money which could then be used to plug the holes created by the failed projects.

On top of this, Enron’s M2M accounting made its crazy 15% earnings increase goal all the crazier by bunching profits. Under normal accounting standards, the profits made from a powerplant or futures contract would be stretched out over years or decades, but under M2M, the earnings are counted all at once. Therefore, under regular accounting, beating earnings requires a comparatively small bump in profits compared to the mountainous profit leaps required by M2M. These higher targets put all the more strain on Skilling and the executives to bend the rules to hit their Wall Street goals.

Also, M2M created a classic principal-agent problem. While Enron had an incentive to see its projects and projections to completion so that it could collect its earnings, the individuals making the deals didn’t have the same incentive. Amongst the myriad of Enron’s bad management decisions was an over-reliance on deal-based bonuses with employees often getting a cut of the immediately-realized M2M profits.

Combined with Enron’s “start-up mentality,” this encouraged a frenzied obsession with closing deals, regardless of whether they made sense. Skilling’s traders rushed to sign long-term futures contracts and Mark’s team rushed to build low-margin powerplant monstrosities in unstable developing countries, all on the basis that they would get a big bonus today and not have to worry about the operation’s viability 20 years down the line. As a result, even putting aside the shoddy accounting, Enron’s major deals tended to be weak by industry standards.

Of course, like all Ponzi schemes, this couldn’t last forever. Even with more borrowed money coming in, Enron’s real and accounting earnings were too far apart. This problem was greatly exacerbated by…

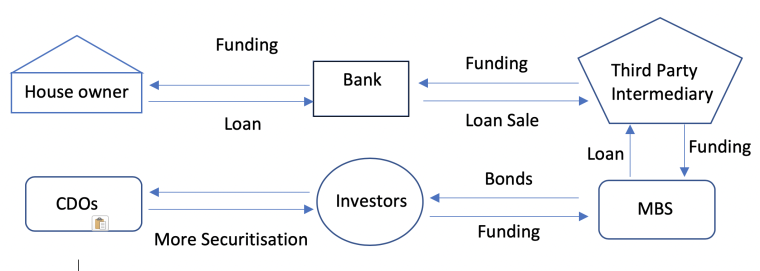

Securitization

Skilling’s aversion to assets was legendary in what McLean calls “Enron lore.” To Skilling, holding on to pipelines and powerplants while Enron was sitting on the incalculable potential of financial trading, was sort of like planting crops on an oil field. So when Skilling became COO in 1997, one of his top priorities was to cash in on Enron’s assets as soon as possible and redirect capital to trading. However, Skilling also had to maintain the illusion that Enron was still a “logistics company” with an asset base, so he couldn’t just liquidate Enron’s assets en masse.

Fortunately for Skilling, “securitization” was all the rage on Wall Street in the late 90s, and it offered the perfect solution.

A security is a contract that represents ownership of an asset; for instance, stocks and bonds.

The advantage of owning a security over an asset is that a security can have flexible terms which augment the value of the underlying asset. For instance, a futures contract is a type of security which allows individuals to own commodities at a future date and price, rather than just owning the commodity directly.

Securitization is the process of converting an asset to a security. A common version of this process is mortgaging a house, where the value of the housing asset is converted into a mortgage security. Because the bank is providing money upfront for the house, the bank charges interest on the repayment of the mortgage over time.

Basically, Skilling mortgaged every physical thing that Enron owned. In doing so, he raised an enormous amount of short-term cash, but put Enron on-the-hook to repay even higher amounts in the future.

For instance, imagine Enron builds a powerplant in 1995. It projects earning $100 million over 10 years. Then Enron packages the powerplant into a security and sells it to a bank. Enron gets $100 million in 1995 and promises to pay the bank $120 million over the next ten years.

There is nothing inherently wrong with such a deal, just as there’s nothing wrong with a person mortgaging his house when he needs the money. The problem with Enron’s particular securitization strategy was four-fold:

First, the company really did mortgage just about every solid thing it owned, which leveraged Enron to the hilt.

Second, Enron had a chronic cash-flow problem. Securitization alleviated the problem in the short-run and made it far worse in the long run as it had to pay back the mortgage principals + interest. By securitizing so many assets, Enron gave itself a thousand tiny cuts in exchange for a huge pile of cash, but then it was slowly bleeding even more cash forever.

Third, and most crucially, Enron’s securitization price points were based on its wildly-inflated M2M accounting. Once again, this was great for Enron in the short-term since it could get more cash than its asset was really worth, but it was terrible in the long-run when Enron had to pay back more cash than its asset was really worth. And yet again, this greatly exacerbated Enron’s chronic cash-flow problem.

Fourth, Enron became utterly addicted to securitizing. It became common practice for Enron to make a deal and then securitize it for cash before the ink dried. In doing so, Enron sort-of kind-of brought its M2M accounting into reality by raising long-term profits immediately (albeit at a reduced rate). But of course, all that cash needed to be repaid with interest. In classic Ponzi scheme form, Enron needed to securitize more assets in the future to cover the cash outflow created by older securitization.

Thus, over the course of Skilling’s reign, securitization transformed from a way to get money to fund ambitious investment projects, to a way to keep a cash-desperate company away from bankruptcy for just a little longer.

Tobashi Schemes

Enron promoted itself as a “logistics company” to inflate its P/E ratio, it used M2M accounting to massively inflate its earnings, and it used securitization to temporarily bridge the ever-widening gap between its reported and real earnings, all to grow its stock price and expand operations.

But still… how did Enron cover its losses? Trading is inherently volatile, and there was no way even Enron’s ace traders were bringing in 15% earnings growth each year. And the combination of M2M and securitization would crater cash-flow and mount costs at an accelerated rate over the years. Even with Enron’s marketing magic, how could they hide their balance sheet problems from investors.

The answer lay in “Tobashi schemes,” though neither McLane nor Enron’s executives used the term, as far as I know. A Tobashi scheme occurs when a company transfers debt or bad assets to another entity and then obscures the connection between the two companies. It is extremely simple in concept, but extremely complex in implementation.

Company A can’t just set up Company B and then transfer all its debt to it like Creed Bratton. Investors, rating agencies, and the IRS are not that stupid. But Enron’s creative accountants managed to discover and invent enough loopholes to outsmart them all… at least for a while.

The visionary behind Enron’s Tobashi schemes was Andrew Fastow, a banker initially hired by Skilling’s trading department who eventually became Chief Financial Officer (CFO) of Enron. Ironically, in a company stuffed with admittedly brilliant individuals, Fastow was one of the few top executives who generally wasn’t noted for his intelligence. His work performance was middling, and nobody expected him to rise through the ranks. He was considered ambitious, but a try-hard, and he clashed against Enron’s culture with his impeccable fashion sense and openly liberal politics.

But Fastow had two major assets. First, he was a natural politician, and so he made up for a lack of work-achievements by socially maneuvering his way to the top. Second, he was a prolific “ideas man.” One executive said something about Fastow like, “he has 100 ideas per day, and five of them are really great! The rest are awful.”

Fastow caught Skilling’s eye with his use of “special purpose entities” (SPEs). SPEs are basically tiny companies grown out of larger companies for specific purposes, like dolling out complex equity deals or taking an enormous risk on an asset without risking bankrupting the entire company. Fastow figured out how to transfer Enron’s debt to SPEs to make Enron look financially healthier on paper than it really was.

For example, when Enron wanted to buy out a partner in a joint energy venture, but didn’t want to raise the debt necessary for the buy out on its balance sheet, Enron created an SPE to hold the debt. The bank that lent the money to the SPE knew it was backed by Enron, but Enron’s shareholders didn’t.

The loopholes and tricks Fastow used to avoid disclosing these SPEs to Enron’s shareholders were complex and arcane, and not really worth delving into. They tended to involve things like getting Enron executives’ wives to legally own the SPEs, or having Enron pay generous bonuses to executives in exchange for them investing their own money in the SPEs, or “layering” financial transactions through multiple SPEs to confuse auditors. It certainly didn’t help Enron seem less shady when it named its SPEs things like “JEDI” and “Chewco.”

As with virtually all of Enron’s schemes, the SPE operations started fairly small; for example, Enron might shovel a bad futures contract into an SPE to hide $10 million in losses and meet the quarter’s earnings projection. But once again, Enron became addicted to their schemes and grew more audacious over time. A handful of SPEs in Skilling’s trading operation ballooned to over 100 entities after Skilling became COO. It’s hard to keep track of exactly how much money they hid, but by the late 90s, Enron was already hiding hundreds of millions of dollars in debt and bad assets from its shareholders.

Fastow kicked the scheme up a notch in 1999 with the creation of two new SPEs called LJMs (“Lea Jeffrey Matthew,” Fastow’s wife and kids). These SPEs were designed to be bigger than the old ones and to more aggressively transfer bad assets in particular.

Fastow’s plan was to set up these SPEs and personally manage them as investment companies while also being the CFO of Enron. He called a meeting of all the major banks Enron worked with (Wachovia, JP Morgan, Citigroup, etc.) and pitched LJM as an independent investment fund which would choose elite Enron assets for strategic, high-return investment, which Fastow had access to because of his position as CFO at Enron.

All the bankers scratched their heads in bewilderment. Fastow’s plan was a blatant, colossal conflict of interest. They asked him how Enron could possibly allow its CFO to use outside money to profit off Enron investments.

Fastow said not to worry about that. Then he said that Skilling was fully behind him. Then he said that Skilling would be super disappointed in any bank that didn’t pitch into JLM, implying that Skilling would cut any bank that didn’t play ball off from Enron contracts.

The banks raised over $400 million. In their investment reports, most banks stated in private reviews that they didn’t think LJM would make any money, but that they invested just to keep Enron happy so they could keep getting its business.

With $400 million at his disposal, Fastow ran an absurd accounting scam through JLM. A standard maneuver might be:

- Enron is going to fall $50 million short of its quarterly earnings target.

- Fastow identifies a crappy Enron powerplant project which has been stuck in development hell for five years, but is worth $60 million according to M2M projections.

- LJM buys the powerplant for $50 million.

- Enron hits its quarterly earnings target.

- A few months later, Fastow sells the powerplant back to Enron for $60 million. LJM banks a $10 million profit, from which Fastow takes a cut as the manager of the fund. At the same time, Enron pays Fastow a bonus for his brilliant work as CFO.

Basically, LJM and Enron played “hot-potato” with assets to meet short-term financial goals, and with each transaction, Fastow picked up a personal fee.

So, Fastow made a ton of money for managing the whole operation, Enron maneuvered its assets and cash to hit earnings targets, and the banks that backed LJM made money through LJM’s investments. Everyone won! That is, except for the shareholders and analysts who were completely fooled by Fastow pushing numbers around a page.

However, as with all of Enron’s SPEs, Enron was ultimately liable for the entire operation. If LJM or any other SPE collapsed (as they occasionally did), Enron would be on the hook to repay creditors. Fastow and Skilling seemed to get so deep into the SPEs that they didn’t realize this. They weren’t actually creating money out of thin air or discharging liabilities, they were just hiding real debt and liability that totally existed and that they would need to pay for eventually.

The Tobashi scam reached its apex with the Raptor SPEs. Like the LJMs, the Raptors were an even more audacious, desperate means of hiding the bloated, debt-ridden beast Enron had become. Only an insane bit of accounting magic would keep Enron afloat for any longer.

The Raptors were four SPEs which were granted $2.1 billion worth of Enron assets, mostly in Enron stock. Enron then engaged in selective swaps with the raptors where Enron bought put options on its own toxic assets it gave to the raptors. If the assets went up in value, Enron would ignore the puts and let the assets ride. If the assets went down in value, Enron would trigger the puts and claim an equivalent value in Enron stock from the Raptors to cover its losses. Thus, Enron officially had a hedge to cover its bad asserts, which made the company appear healthier on its balance sheet.

It’s tough to wrap one’s mind around this circularity. Basically, Enron told the public that the Raptors were hedging Enron’s assets… but Enron was financing the Raptors. So Enron was hedging itself… which is not hedging at all.

As with so much of Enron, the Raptors were a giant smokescreen. Money, assets, and financial derivatives were being pushed around on paper, but there was no value being created, or even financial restructuring. Enron was just pretending that its bets were insured through complex, multi-layered accounting processes which nobody besides Fastow, Skilling, and a small cadre of executives could follow.

Enron had experienced problems with many of its SPEs over the years, but the Raptors were the first ones to decisively fail. They were simply too big, convoluted, and risky to sustain themselves.

The key problem was that the puts were tied to the value of Enron’s stock price, and Enron had the misfortune/bad judgement to form many puts when Enron’s price hit close to its all-time-high. As Enron’s price steadily slid down, the puts were triggered, which required the Raptors to repay Enron with its own stock. The problem was that Enron stock was worth $1 billion less than the original contract. Thus the supposed hedge failed to actually hedge Enron’s failing assets. To compound the absurdity, Enron had claimed $500 million in earnings on the Raptor deals by using M2M to project its fees on the put options into the future.

Enron’s long-standing utterly oblivious accounting firm, Arthur Andersen, simply couldn’t ignore what was happening. The absurdity of the circular hedge was such a blatant violation of accounting standards that AA forced Enron to shut down the Raptors in 2000. In one fell swoop, Enron’s balance sheet lost $1 billion in shareholder equity and $500 million in earnings. This not only further strained Enron’s imploding financial structure, but encouraged shocked investors to finally dig deeper into Enron’s shady numbers, thus prompting the scrutiny that would collapse Enron the following year.

The High-Level Explanation

The Mid-Level Explanation was my easy-to-digest nutshell of Enron’s core problem. The Low-Level Explanation got into the details of Enron’s practices. Compared to those two sections, my High-Level Explanation will be more speculative, as I’ll explore the personal, psychological, legal, and ideological forces behind Enron’s rise and fall.

The Smartest Guys in The Room

Enron was run and staffed by brilliant individuals. This is a point McLane hammers home over-and-over again in the book. Skilling was some sort of prodigy and probably the smartest of the bunch, but his successor at the trading desk, Greg Whalley (an Ayn Rand fan), may have been his equal. Lay was lackadaisical but a visionary who laid the foundations for Enron’s climb. Kinder is now one of the wealthiest individuals on the planet. Mark was short-sighted, but a powerfully charismatic figure. Even Fastow undoubtedly had his edge in designing such complex accounting structures that almost two decades later, no one entirely understands them.

Working under these figures were thousands of extremely intelligent executives, analysts, traders, and accountants. Skilling imported the hiring practices he learned from McKinsey – raw intelligence was by far the most important metric. While early-Enron hired mid-career workmen who had been in the industry for a decade or more, Skilling lapped up MBAs from Harvard and Yale or ace traders from Wall Street. Work experience could be built, recommendations were manipulable; intelligence was the only factor that really predicted job performance. Skilling believed that if a group of super-smart people was put in a room and given a lot of money, they could do anything.

One of the biggest take-aways I got from learning about Enron was the double-edged nature of intelligence. Intelligence isn’t just a morally neutral tool than can be used for good and evil; rather, the Enron story displays the potentially distortionary impact of high intelligence on moral decision-making. It lends evidence to the notion that extremely intelligent people can be subtly incentivized to be (systematically) dishonest because their intelligence lowers the cost and raises the potential benefits of circumventing rules.

As far as anyone can tell, there was very little direct, tangible, provable fraud at Enron. There were a few instances of embezzlement, but I’m not even sure if the levels passed the baseline at normal large corporations. There was no grand plan to build Enron into the accounting monstrosity it became. Enron grew into itself not through conscious dishonesty or concerted effort, but from lots of smart people making lots of decisions to bend and evade the rules. Many or most of those decisions probably made sense when they were made, or at least were understandable; even as Enron collapsed, there were plenty of people inside and outside the company who thought the firm’s failure was a fluke (Skilling believed Enron fell victim to an untimely bank run).

Without going too much into psychological navel-gazing, the sense I got from learning about Skilling and the gang is that they genuinely thought they were too smart to be bound by the rules. I mean that not just in a cynical, arrogant sense (though there was definitely plenty of that), but in an earnest, understandable sense. Something like: “if me and my ideas and my company are so much more sophisticated than the market and its regulators, then why should we be bound by them?”

So while the Enron executives were clearly wrong, both morally and practically, I can’t help but somewhat sympathize with them a little bit. I think it’s entirely plausible that sometimes individuals are put into positions and contexts where the decisions that seem to make the most sense, are simply wrong.

Rules are for the Mediocre

I used to live in a city where pedestrian crosswalks were closely monitored and their rules strictly enforced. Then the “red man” was present, no one could cross; when the “green man” appeared, everyone crossed. Individuals caught crossing when they weren’t supposed to were screamed at by permanently posted police officers. If the offenders were lucky, they would just be scolded; if unlucky, they’d get fined. By the time I left this city, dozens of crowded crosswalks had camera-monitoring systems which automatically fined individuals for crossing improperly. The criminals wouldn’t even know they were in trouble until they got a text from the government minutes after the fact.

These crosswalks made my blood boil. Tens of hours of my life have been wasted waiting on the sidewalk for the green man to come, even though I almost always had opportunities to cross before he arrived. It didn’t matter if it was the middle of the night and there were no cars, or if it was a slow traffic day, or if there was a wide gap in the normal flow of traffic; regardless, the stupid rules stopped me from getting to where I needed to go. My plans, my travel, my pace, my goals, were chronically hindered.

Eventually, I found myself thinking that crosswalk rules only exist for dumb people. Or at least uncoordinated or oblivious people. I am supremely confident in my ability to ignore crosswalk rules at my discretion and get through my entire life without getting hit by a car. But I don’t have that confidence in everyone. Idiots will walk into traffic while looking at their phones, or run across the street when late for work, or misjudge the distance of a car, or whatever, and get themselves killed. I admit that the crosswalk rules are legitimately valuable for such people.

But that’s a depressing thought. Crosswalk rules, like so many other rules, are made for the sake of the mediocre. People with sufficient intelligence, athleticism, and awareness don’t need crosswalk rules, only those lacking such basic capacities do. Yet, we are all bound by these lowest-common-denominator rules. My time is wasted and my life is hindered because mediocrity is the standard.

I think that’s sort of how Skilling and the Enron executives saw the whole world. They were the smartest guys in the room. Enron was the most innovative company in America, and maybe the world. Why would they follow rules designed for mediocrity?

US financial accounting standards are admittedly a lot more complex than crosswalk rules. But still, they weren’t designed with extraordinary companies in mind. How healthy did Google or Apple look on paper during their early days? How healthy do Tesla and Uber look today? Are P/E ratios valid for start-ups? Standard accounting rules evolved to capture the ordinary business dealings of ordinary firms. But Enron was no ordinary firm.

Consider credit ratings. Credit agencies and banks examine an enormous number of standardized factors when evaluating a company’s credit: most concerning to Enron was its existing debt load. Understandably, ceteris paribus, the more debt a company owes, the less likely it is to be able to pay back more debt, and therefore the lower its credit rating. With its ever-burgeoning debt load, Enron was constantly worried about losing its investment-grade credit rating, thereby stemming the flow of capital needed to invest in new projects and keep itself afloat.

It’s not hard to imagine Enron executives reasoning that the credit agency models couldn’t possibly account for the full range of companies in the market, especially companies as unusual as Enron. Sure, ordinary companies may be under threat of default once they reach a certain level of debt, but Enron had always been debt-heavy. It had always had creditors breathing down its neck. It had always borrowed huge sums of money to throw at projects that others thought were bad bets. Yet Enron survived and thrived, and saw its stock price shoot through the roof year-after-year.

So why not hide some of that debt on off-balance sheet special purpose entities to trick the rating agencies into maintaining Enron’s investment-grade rating? Even if Enron had to push its debt limits for a few quarters, it could always pay it off with the next great project.

A very charitable interpretation of Fastow and Skilling’s SPE trick is that they were “smoothing out” profits and losses. Trading is naturally volatile; a ten-year futures contract might lose money for five years and then make money for five years as prices change. With M2M accounting, Enron had to report earnings and losses immediately as projections changed, so their gross earnings would be equally volatile. But with the SPEs, Enron could put losing assets aside for a time and then take them back later when they became profitable or Enron could absorb the losses without missing an earnings target.

To Enron executives, these tricks weren’t fraud. They were creative. They were a novel way of doing business. They were doing things that were literally too sophisticated for the rating agencies to understand. So why should Enron be bound by ordinary credit standards?

They figured: as long as it all works out in the end, as it always did, bending the rules a little bit was fine. And they were right… until they weren’t.

Corporate Culture

This mindset wasn’t just encapsulated in Enron’s business outlook, but its entire corporate culture. Lay’s hands-off approach cultivated a laissez-faire atmosphere, but Skilling’s psychology/ideology cemented an environment of ambition, risk-taking, and ruthlessness. Working at Enron was definitely a love it or hate it experience.

On the upside, employees were well-compensated, had plenty of upward mobility potential, were driven to start and run their own projects, and were allowed to move rapidly between sectors of the company to find their niche. By all accounts, parts of Enron really did have a strong esprit de corps. There was a sense that Enron gave unmatched support for individual initiative, and many mid-level traders and analysts ended up running their own divisions and getting rich when Enron backed their ideas. The traders especially had a sense of camaraderie and importance as they knew they were the profit anchor upon which the rest of the company expanded.

Enron’s employees worked to the bone, but they also got the best. They only flew first-class or private. They only stayed in five-star hotels. They only got catered work lunches and dinners. They had annual employee and executive retreats to tropical islands, ski resorts, African safaris, and European villas. Such extravagances persisted even as Enron’s staff ballooned into the tens of thousands and stretched across the Atlantic Ocean. Some employees even found the lifestyle so addicting that they couldn’t bear leaving it behind for another company. Lay and Skilling expected their people to dedicate their lives to Enron, but they took care of their people in turn.

One of the most favored management trends in Enron by its employees was the sense that failure was permissible as long as one failed for the sake of ambition. Skilling constantly encouraged employees to pitch their ideas, and he offered to fund their ventures, but with the full understanding that most ventures wouldn’t succeed. This acknowledged safety net not only incentivized more ideas, but made employees feel like they were genuinely looked after.

Skilling wisely made both success and failure a matter of public notice. He once became obsessed with an employee’s energy trading bot (a novel concept at the time) and would come down to the trading floor every day to ask how it was doing. Skilling only pulled the plug after the bot lost tens of millions of dollars, but the employee suffered no repercussions.

In another famed incident, Skilling hired an early 20-something ace trader from another firm. The employee made tens of millions for Enron in his first two months, and then lost in all in a single day. After another ill-fated trade the same week, he had lost Enron tens of millions of dollars on net. Skilling took the crying employee aside on the middle of the trading floor, gave him a pep talk, and sent him back to work. The employee suffered no repercussions.

As stated, many employees commented that Enron felt like a giant start-up, even to its dying day. Plenty of the traders and executives loved working there. They were invigorated by the daring atmosphere where all was encouraged, everything was permitted, and everyone got rich.

Many people loved working at Enron, and just as many people hated working at Enron. It wasn’t just the boring sticks-in-the-mud who couldn’t kick back and enjoy a nice private jet ride at Enron shareholder expense, but good, competent employees who simply couldn’t keep up with the madness of it all. Not everyone wants to work in a start-up.

Many people want clear directives, firm deadlines, and a proper organizational structure for support. Enron had very little of this stuff. Instead, its decentralized structure had entire departments fighting each other for resources. Sure, Enron corporate was supportive of individual employees, but Enron corporate also pitted traders against analysts, oil against natural gas, the European gas team against the American gas team, etc. The competition was so extremely that rival departments often cannibalized each other’s profits as they competed for common customers. Arguably, Enron was less of a start-up than a massive collection of start-ups trapped in a hyper-aggressive marketplace with each other.

The all-encompassing sense of competition was maximally focused at quarterly personnel evaluation meetings. All employees would be given evaluation forms to rate all other employees in their departments. Executives would rate other executives. Then Skilling would meet with individual departments and his executive team, and they’d go one-by-one through the evaluation forms to aggregate the results and read comments, all while the discussed employee listened (or argued). Top-ranked employees would get promotions or raises. Bottom-ranked employees were put on probation.

This process naturally devolved into gaming. Employees formed alliances against each other. Executives garnered favored lieutenants where loyalty was exchanged for backing. Executives horse-traded to get their lieutenants higher ratings and bonuses. Skilling somehow thought these meetings were extraordinarily valuable for keeping the company honest, but most employees hated them with a passion, especially the less politically savvy ones who found their ratings tanked by ambitious peers.

Then there were the reorganizations. Skilling held the notion that any smart employee could become a productive employee if he found the right place at Enron. So Enron mandated constant reshuffling of personnel between departments. A single individual might find himself working as an analyst, trader, accountant, deal-maker, and in human resources over the course of a single year. Some employees indeed found their niche, latched onto a friendly executive, and road their way up the corporate ladder. But plenty of other employees felt their time was wasted and that they never did anything useful at Enron because they never had the chance to dig in and try.

McLane stresses that Lay and Skilling were terrible personnel managers. They were great long-term planners and could be charismatic in their own ways, but they were awful at day-to-day dealing with people. So, for the most part, they simply didn’t do it.

For instance, Lay and Skilling virtually never fired anybody. It didn’t matter if an employee was incompetent, despised, treacherous, or troublesome, both men could almost never bring themselves to pull the trigger. Lay was too friendly; Skilling was too aloof. Both hoped that bad employees would leave voluntarily, and they sometimes did, but never without gargantuan golden parachutes.

This non-confrontational management style had its worst impact on costs. All those private jets (Enron had its own fleet), 5 star hotels, and exotic vacations really added up. When the rare sober accountant at Enron tried to put a stop to the waste, Lay and Skilling always buckled under employee pressure and kept it going. Of course, spending millions of dollars on luxuries was the last thing that a chronically cash-strapped company like Enron needed, but its management simply didn’t have the strength to resist its own cultural inertia.

I see most of Enron’s management quirks, both the good and bad, as further products of the too smart for the rules mindset. Lay and Skilling ran Enron differently than most other companies because they thought Enron was too special to be bound by standard management rules. Normal corporate heads would have fired a new employee for recklessly gambling away millions of dollars, or would try to actively solve disruptive employee disputes, or would try not to expand the corporate jet fleet while having trouble paying debt interest payments… but Enron wasn’t run by normal corporate heads.

This mindset seemingly bled into the personal lives of Enron’s executives. Even beyond the annihilation of any pretense of work-life balance, nearly all of Enron’s major executives cheated on their significant others and got divorced while working at Enron. Mark cheated on her husband with a married superior, and she took her boss’s position after he left the company. One of Skilling’s top lieutenants, Ken Rice, had the most lurid company affair as he failed to conceal sleeping with one of his analysts for years. Another Skilling lieutenant, Lou Pai, had a well-known passion for spending Enron’s generous per diems at strip clubs. Pai would even have children with one stripper, and eventually marry her after paying his wife over $100 million in a divorce settlement. Even Skilling began sleeping with his secretary, though not until after his long-suffering wife left him.

Lay was happy to distance himself from company operations, Mark wanted nothing more than to be a celebrity, and plenty of other executives were purely monetarily motivated. But Skilling really did seem like a true believer in the Enron vision. That vision was one of a collection of brilliant people repeatedly doing the impossible. They invented new markets from nothing, formulated plans for futuristic industries (including suuuuuper early movie streaming services), and somehow hit the sky-high 15% earnings growth target nearly every quarter.

Yes, they inflated their profits and pushed their debt out-of-sight, but still… it wasn’t all bullshit. It couldn’t have been. Their house of cards wouldn’t have lasted as long as it did if the whole company was fake. The natural gas and oil trading operations really were semi-monopolists of a market Enron invented. The California electricity initiative was a PR disaster, but made absurd profits. Mark’s overseas projects were mostly money sinks, but it was still pretty damn amazing to watch gargantuan powerplants arise in third world jungles.

This is why Byrne Hobart describes Skilling as a “Captain Ahab figure.” Skilling led the charge to generate ground-breaking ideas to chase the numbers, and by all accounts, he became a legend at Enron. He wasn’t a natural leader, but he brought a brooding charisma to the table that pushed executives and employees to formulate and execute ideas just as innovative as his own. His standard 80-hour workweek destroyed his marriage, distanced himself from his children, and brought on periodic bouts of depression. Skilling gave everything he had to Enron for over a decade until he was close to a mental break-down. When Skilling surprisingly resigned from his CEO post in 2001, he told multiple friends that working at Enron “just wasn’t fun anymore.”

That was another perspective-shift for me from learning about Enron. It’s easy to look back on fraudulent operations as inherently rotten, but the Enron case shows that frauds can be led by true believers. And not just short-sighted dupes, but incredibly smart true believers. There was no Bernie Madoff figure in Enron cynically riding out a scam (except maybe Fastow); there were smart people who drank their own cool-aid, and not without good reason.

There’s no doubt that Enron was operating in a reality distortion field, and that was a major underlying factor of its increasingly misleading financial foundation. But Enron exceptionalism wasn’t just the view from inside Enron, it was the universally accepted evaluation among Wall Street analysts, rating agencies, and financial managers across the country who based countless pension plans on unstoppable Enron stock. Skilling regularly got roaring cheers from crowds during shareholder meetings with the announcement of every bold new plan. The late 90s and early 2000s were the dot-com-bubble: conspicuous enthusiasm over unicorn companies wasn’t even uncommon. Arthur Andersen didn’t just sign off on Enron’s crazy accounting due to financial wizardry, but because Enron was Enron. It was the smartest company in the world, so of course it had the most inscrutable accounting.

This is all to say that while Enron was a giant fraud in retrospect, we shouldn’t discount how difficult it was to see the truth of Enron while it was still running. More than that, we shouldn’t discount how understandable much of the fraudulent decisions were in their context. Enron’s fraud probably wasn’t driven primarily by maliciousness, negligence, or incompetence, but precisely by intelligence. That is to say: if very smart people – like Skilling, Lay, the rest of the Enron executive team, the Enron staff, Arthur Andersen, 99% of the Wall Street analysts, and the rating agencies – all continued to create or approve of the giant Enron fraud until it was too unsustainable to survive, then… it’s hard for me to morally condemn any single individual too much.

I’m not saying that Enron’s executives were legally or morally innocent by any means. I’m saying that their errors were probably understandable, though not excusable, given the incredibly strange, stressful, elative context they found themselves in. I’m saying that if I or the vast majority of people I know found themselves working on Enron’s executive team in 2000, I doubt we could have done any better.

Integrity Decay